The Top Socio-Economic Trends Shaping Canada in 2024. This is the first part of the series discussing all aspects related to Canada.

Table of Contents

Part 1

Introduction to Canadian economy after COVID

The COVID-19 pandemic has had significant social and economic impacts on Canada. According to Statistics Canada, the pandemic led to a 17% decrease in output compared to pre-pandemic levels, and over 132,000 hospitalizations and 35,000 deaths.

The pandemic also affected the mental health and well-being of Canadians, with a sharp decline in self-reported mental health, especially among young Canadians.

The economic disruption led to job losses, reduced employment income, and challenges related to inflation and affordability. Canada’s per-capita GDP growth and employment growth were also affected, though there were improvements in 2021.

The government implemented various measures to respond to these impacts, targeting diverse groups of Canadians through its COVID-19 Economic Response Plan.

Government’s Economic Status

Government Debt Status

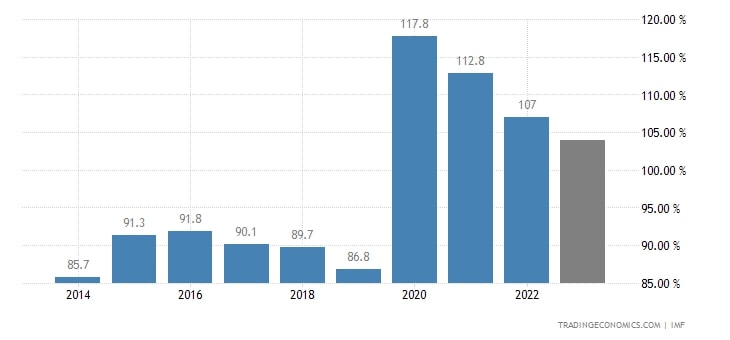

The debt-to-GDP ratio of Canada is a key indicator of the country’s fiscal health. As of 2024, the IMF officially reported Canada’s debt-to-GDP ratio as 106%. However, the World Economics GDP database suggests a lower ratio of 91.9% when using Purchasing Power Parity terms.

This indicates a significant level of government debt relative to the size of the economy. According to Fitch Ratings, they project the general government gross debt (GGGD) to decline further to 96.5% by 2025.

The high debt-to-GDP ratio reflects the economic challenges faced by Canada, and it is an important metric for assessing the country’s financial stability and its ability to meet its debt obligations.

When we have such unsustainable amounts of Government Debt, the economy doesn’t have any additional capital to inject in the economy for any infrastructure development. Leading to economic stagnation as the economic market forces doesnt see any demand for products.

Canada’s Inflation Rate - Provincial Analysis

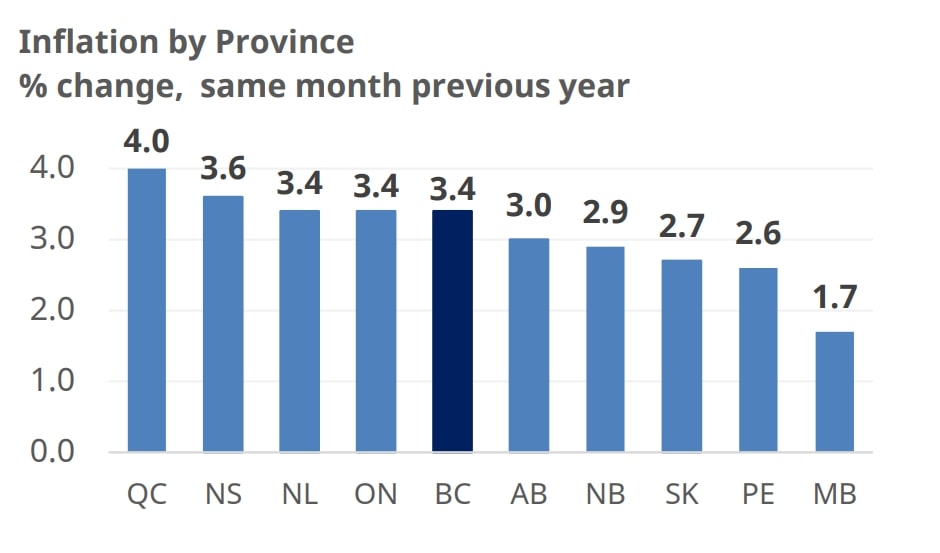

In December 2023, Canada’s Consumer Price Index (CPI) rose by 3.4% compared to December 2022.

The highest inflation rates were observed in Quebec (4.0%) and Nova Scotia (3.6%), while Newfound and Labrador, Ontario, and British Columbia had a rate of 3.4%.

Manitoba (1.7%) had the lowest rate of inflation, followed by Prince Edward Island (2.6%), Saskatchewan (2.7%), New Brunswick (2.9%), and Alberta (3.0%). In British Columbia, consumer prices increased by 3.6% in Vancouver and 2.8% in Victoria.

Canada’s Inflation Rate - Sector Analysis

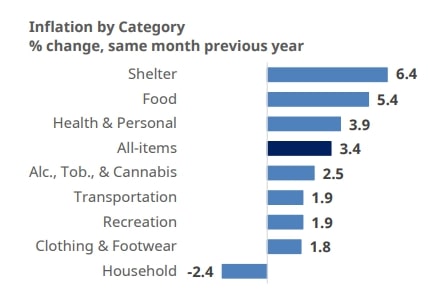

The provided data presents the Consumer Price Index (CPI) for various products and product groups in Canada from December 2022 to December 2023. Here are some key insights from the data:

- All-items CPI increased by 3.4% from December 2022 to December 2023, reaching a value of 158.3 (2002=100).

- Food prices experienced a significant increase, with the Food CPI rising by 5.0% during the same period.

- Shelter prices also saw a notable rise, with the Shelter CPI increasing by 6.0%.

- Household operations, furnishings, and equipment, as well as Clothing and footwear, experienced slight decreases of -1.7% in CPI.

-

Transportation prices increased by 3.2%.

- Health and personal care prices rose by 3.7%.

- The CPI for Recreation, education, and reading experienced a slight increase of 1.7%.

- Alcoholic beverages, tobacco products, and recreational cannabis prices increased by 4.3%.

- The All-items CPI excluding food and energy increased by 3.4%.

- The Energy CPI experienced a slight decrease of -0.4%.

The data indicates a general increase in consumer prices across various sectors, with notable rises in food, shelter, and transportation prices. These increases have contributed to the overall rise in the All-items CPI.

The Energy sector experienced a slight decrease, which partially offset the overall increase in consumer prices.

Key Takeaways

As you can see, the overall economic status of Canada is largely dependent on the enacted government polices. For the next part, we will see the political impact of decisions on Canada’s economy.