The Top Socio-Economic Trends Shaping Canada in 2024. This is the first part of the series discussing all aspects related to Canada.

Workforce Exposure Overview

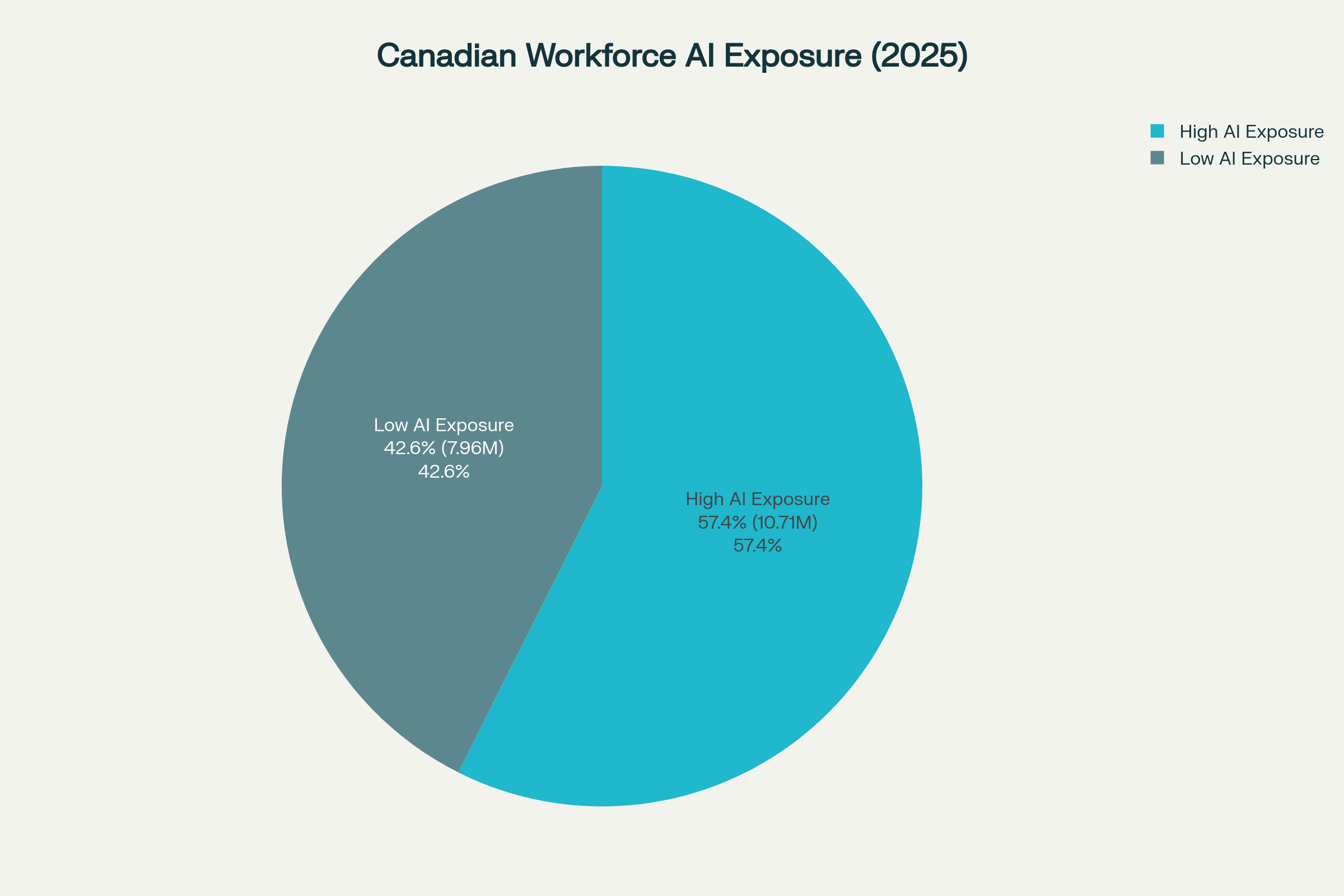

Over half of Canadian workers (57.4%) are in jobs with high AI exposure, representing 10.71 million people.

Over half of Canada’s workforce (57.4%, representing 10.71 million workers) face high AI exposure in their jobs, while 42.6% (7.96 million workers) are in low-exposure roles.12

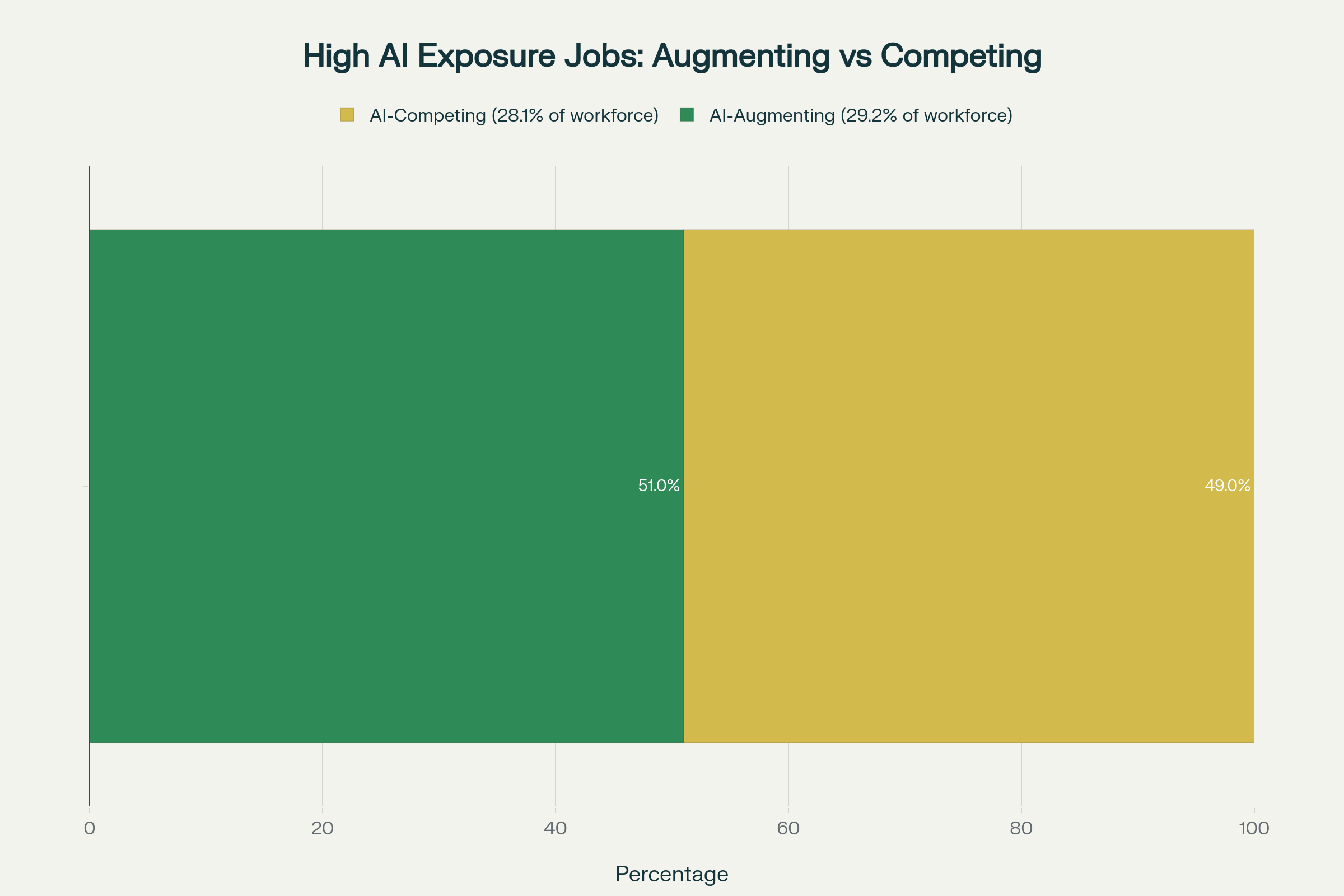

High AI exposure jobs split almost evenly between AI-augmenting roles (51%) and AI-competing roles (49%).

Among high-exposure jobs, there’s an almost even split: 51% are AI-augmenting roles where AI enhances human work, and 49% are AI-competing roles where AI may automate core tasks.2

Employment Growth Patterns

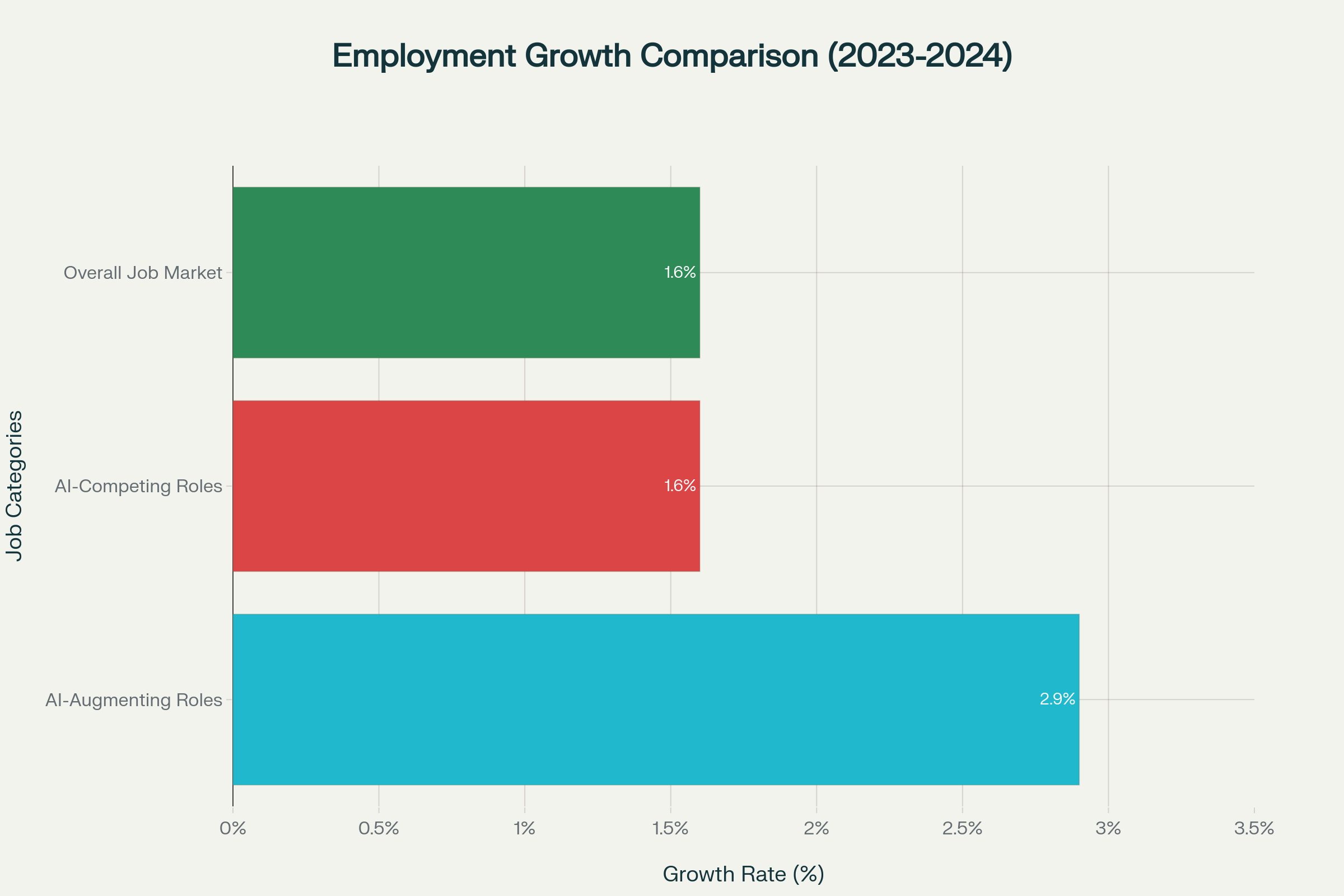

AI-augmenting roles showed stronger employment growth (2.9%) compared to AI-competing roles and the overall job market (both 1.6%) in 2024.

AI-augmenting roles are outperforming the market with 2.9% employment growth in 2024, compared to just 1.6% for both AI-competing roles and the overall job market.2

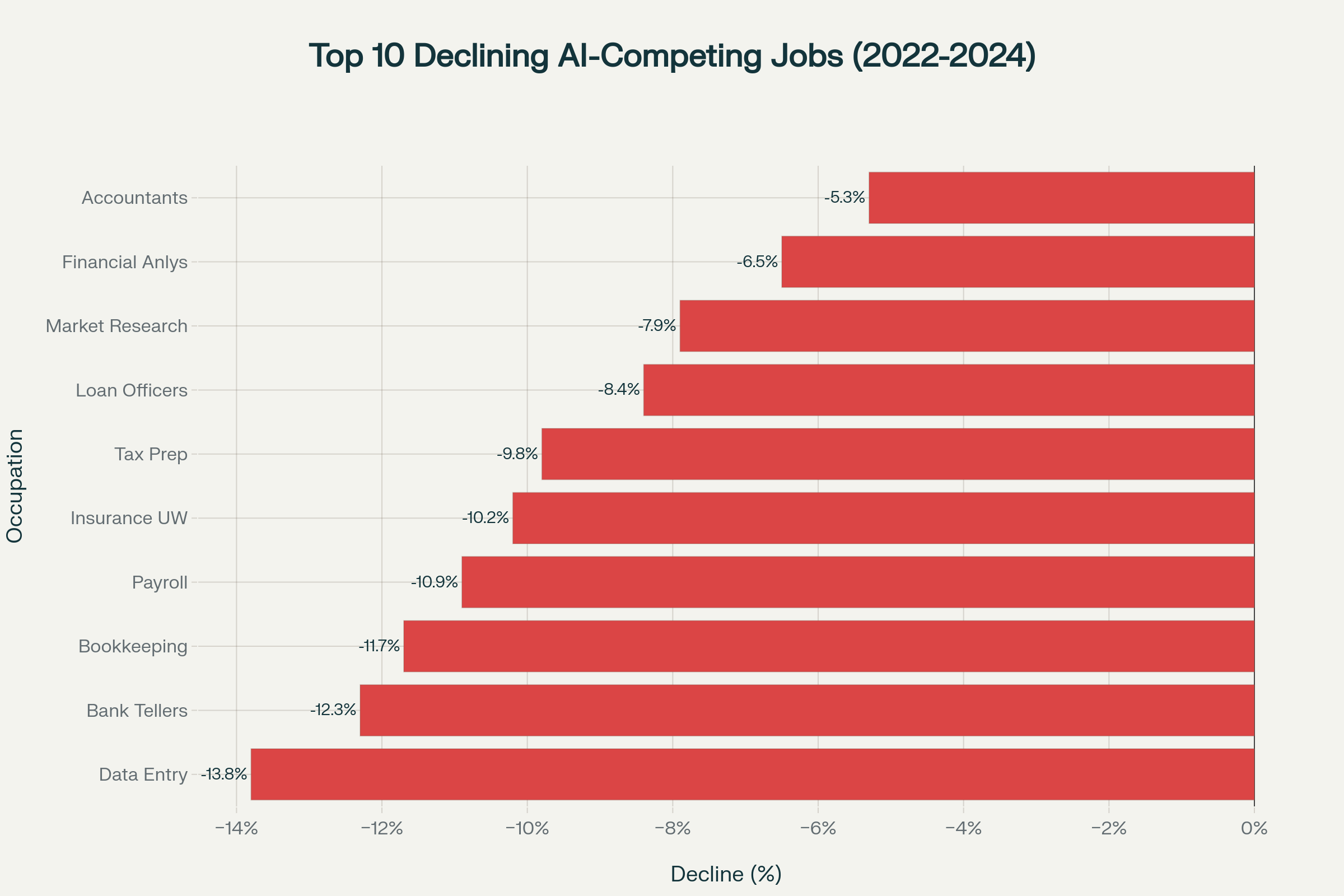

Job Decline in AI-Competing Roles

Desktop publishing operators saw the steepest decline (-12.4%) among AI-competing roles, followed by sales occupations (-11.7%) and editors (-8.7%).

The most affected occupations show significant declines: desktop publishing operators (-12.4%), sales-related occupations (-11.7%), and editors (-8.7%) have experienced the steepest employment losses from 2022-2024.2

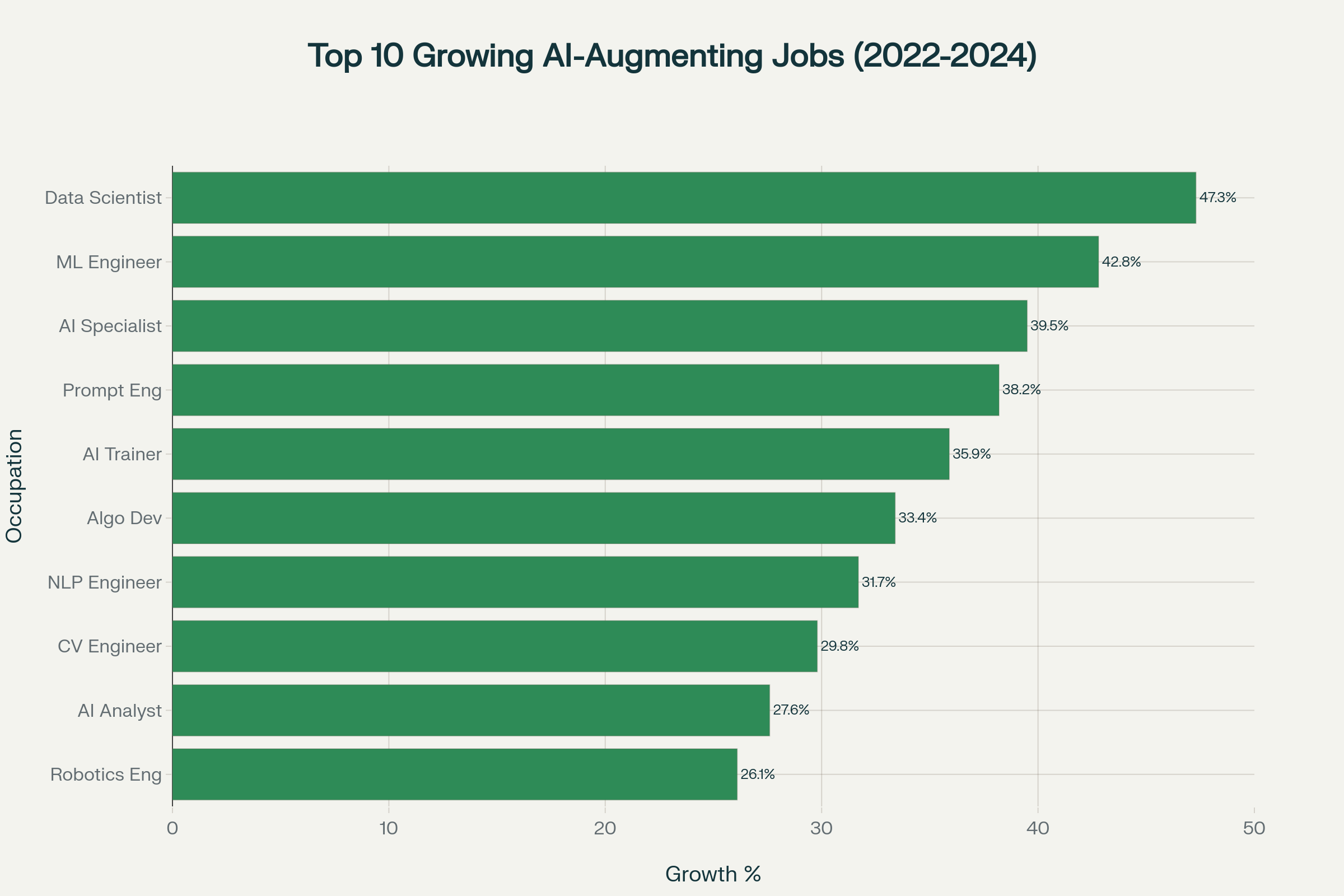

Growth in AI-Augmenting Roles

Conductors, composers, and arrangers experienced the highest growth (+43.4%) among AI-augmenting roles, followed by railway traffic controllers (+42.9%) and religious leaders (+33.3%).

Jobs emphasizing creativity, human judgment, and complex decision-making are thriving. Conductors/composers/arrangers (+43.4%), railway traffic controllers (+42.9%), and religious leaders (+33.3%) lead growth among AI-augmenting roles.2

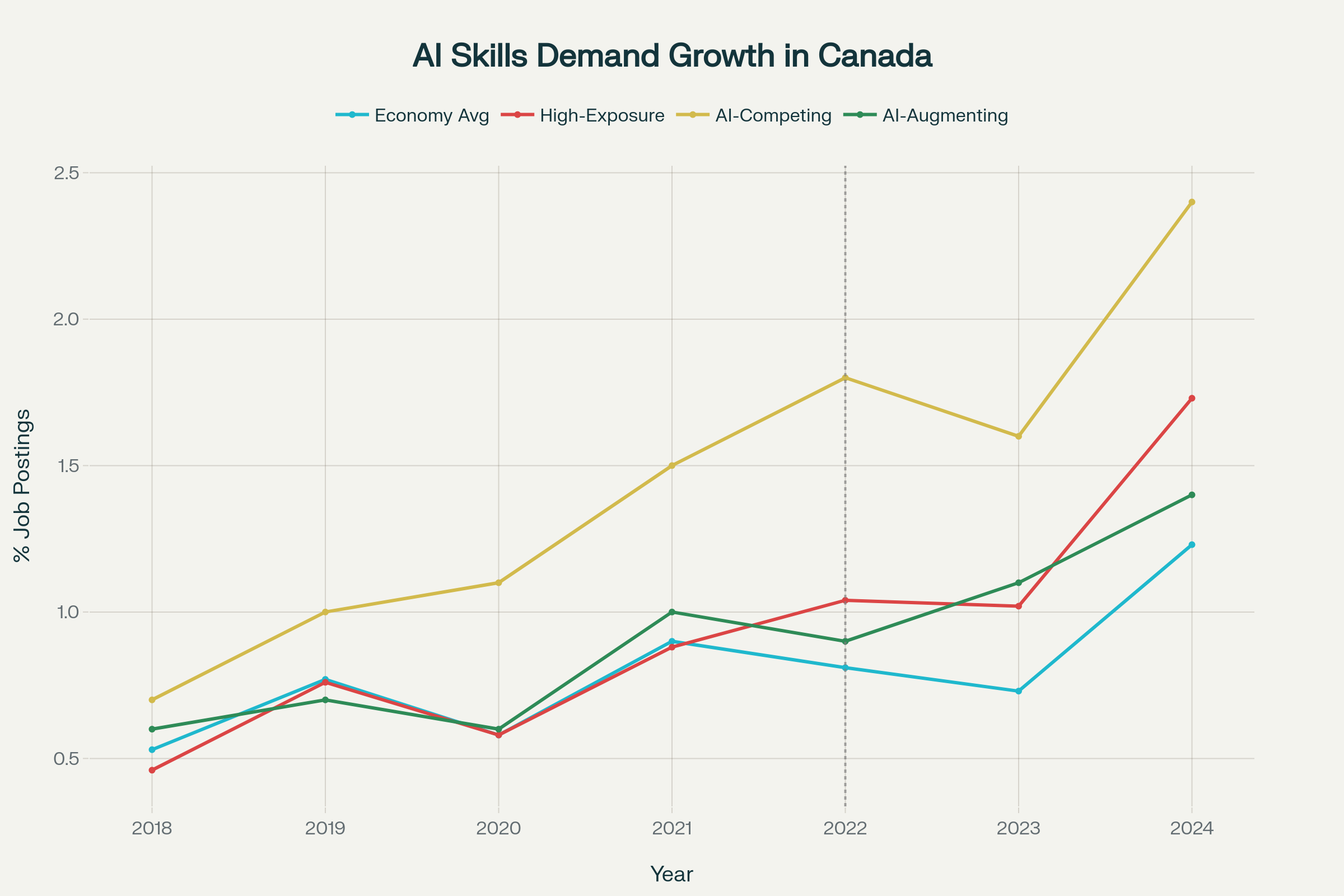

AI Skills Demand Acceleration

AI skills demand in Canada has accelerated since 2022, with high-exposure industries and AI-competing roles showing the strongest growth in required AI skills.

AI skills requirements have surged, particularly after 2022 when generative AI emerged. High-exposure industries saw AI skills demand jump from 0.46% in 2018 to 1.73% in 2024—nearly quadrupling. AI-competing roles show the highest demand at 2.4% of job postings.2

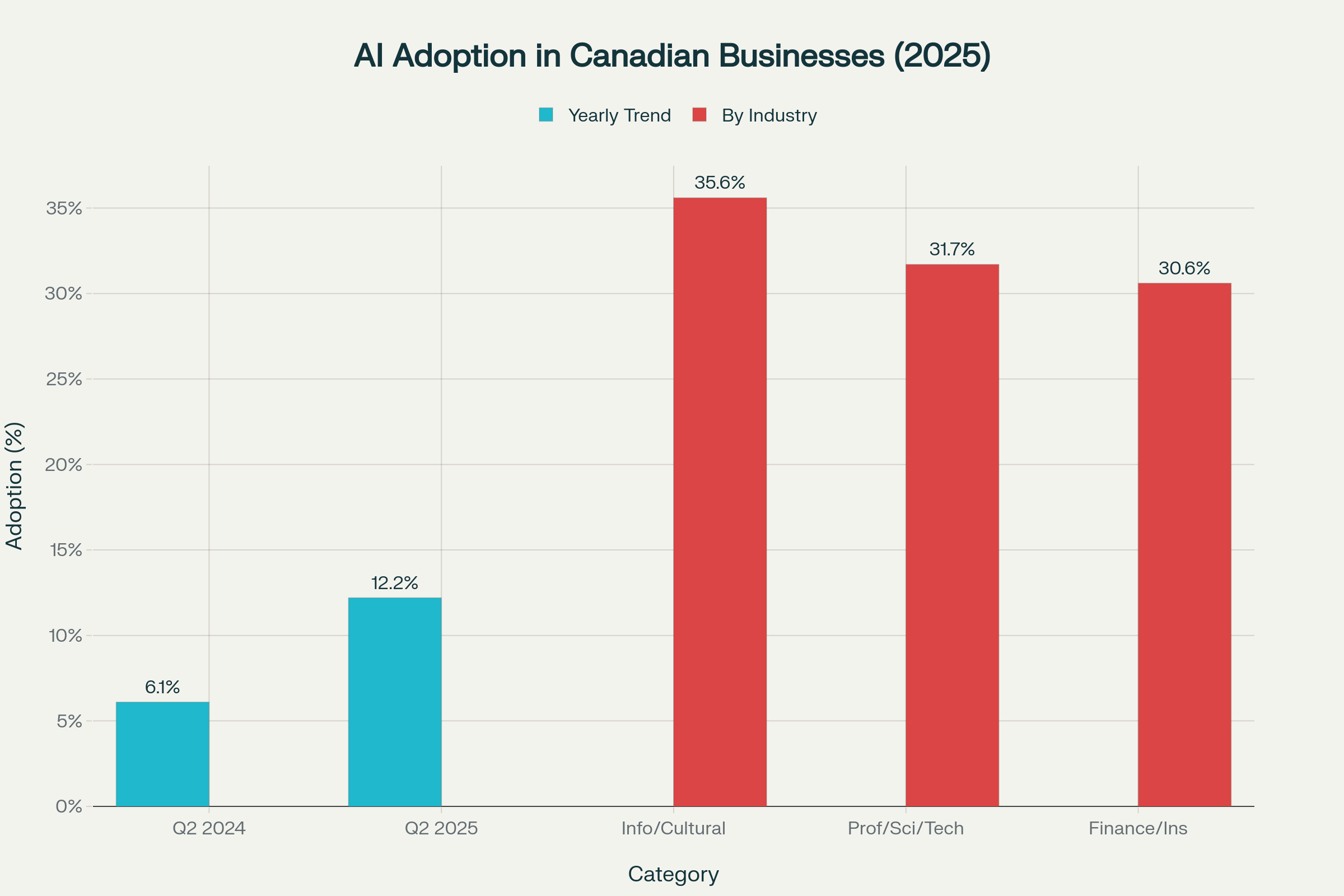

Business Adoption Surge

Business AI adoption in Canada doubled from 6.1% to 12.2% between Q2 2024 and Q2 2025, with information industries leading at 35.6%.

Canadian business AI adoption doubled in one year, from 6.1% (Q2 2024) to 12.2% (Q2 2025). Leading sectors include information/cultural industries (35.6%), professional/scientific/tech services (31.7%), and finance/insurance (30.6%).3

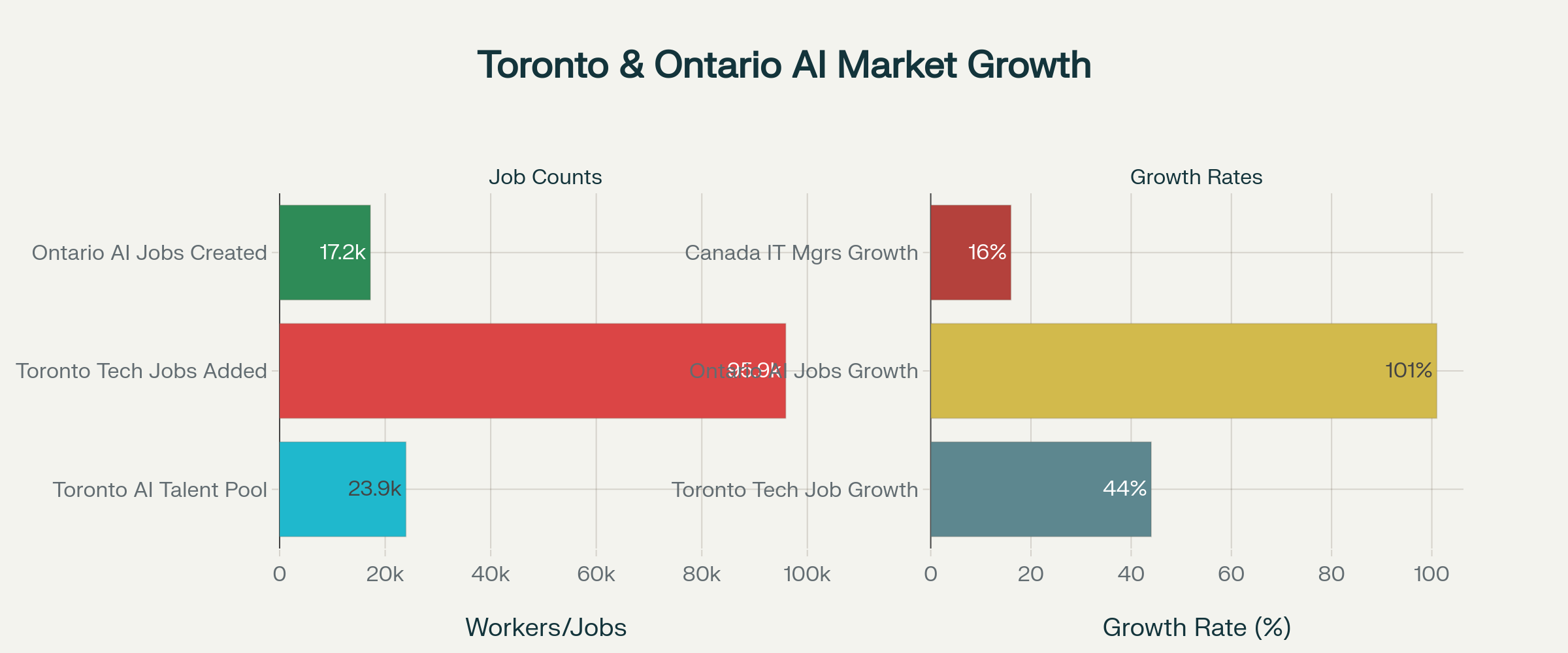

Regional Concentration

Toronto and Ontario lead Canadian AI growth, with Ontario creating 17,196 AI jobs in 2024-25 (+101%) and Toronto adding 95,900 tech jobs since 2018.

Toronto and Ontario dominate Canada’s AI landscape. Ontario created 17,196 AI jobs in 2024-25 (+101% growth), while Toronto added 95,900 tech jobs between 2018-2023 (+44% growth). Toronto now ranks 4th in North America for AI talent with 23,936 workers.456

Financial Services Leadership

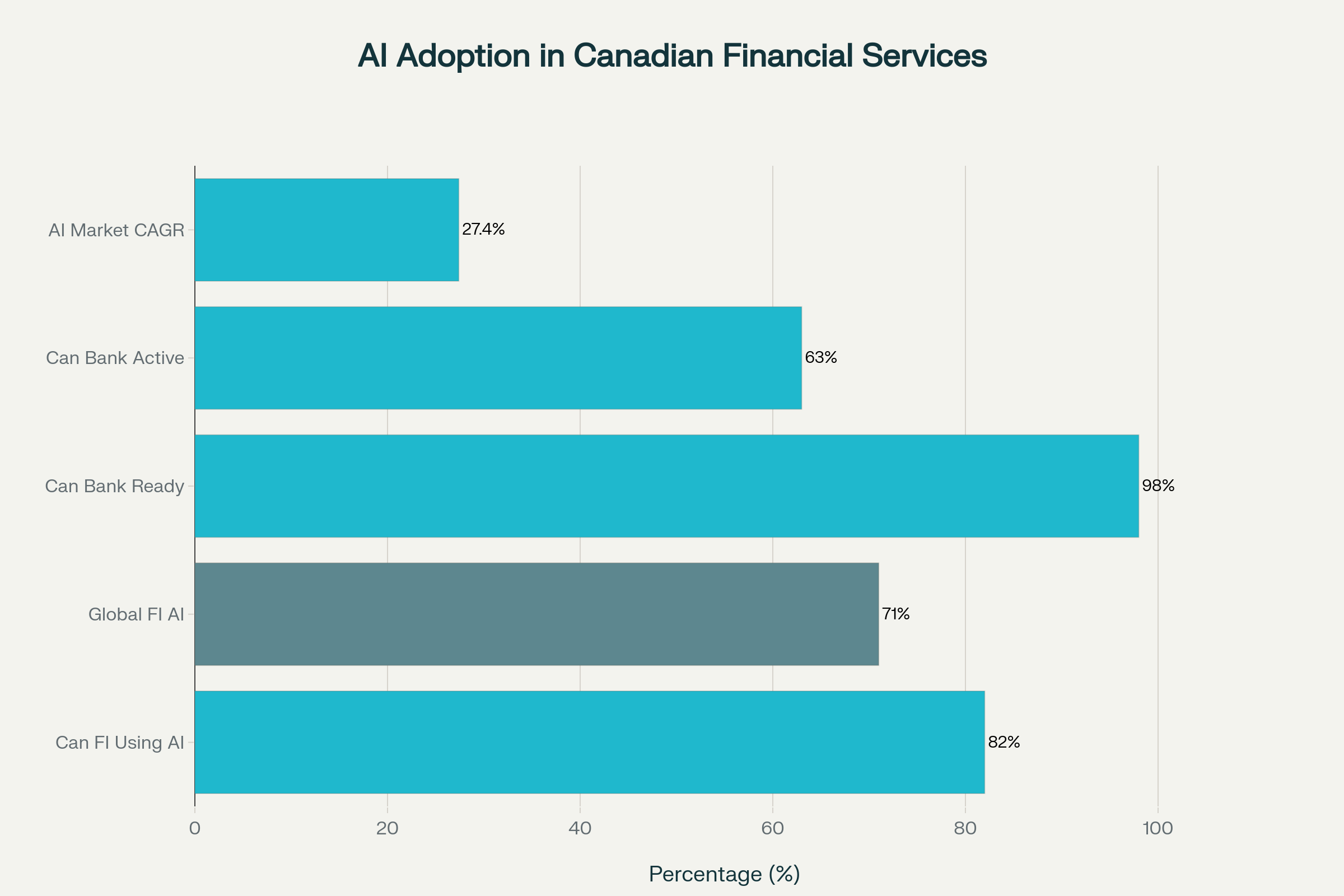

Canadian financial institutions lead in AI adoption at 82% (vs 71% globally), with Canadian banks showing 98% AI-readiness.

Canadian financial institutions lead globally in AI adoption at 82% (versus 71% globally), with Canadian banks showing 98% AI-readiness and 63% actively implementing AI projects. The AI in finance market is growing at 27.4% annually through 2032.789

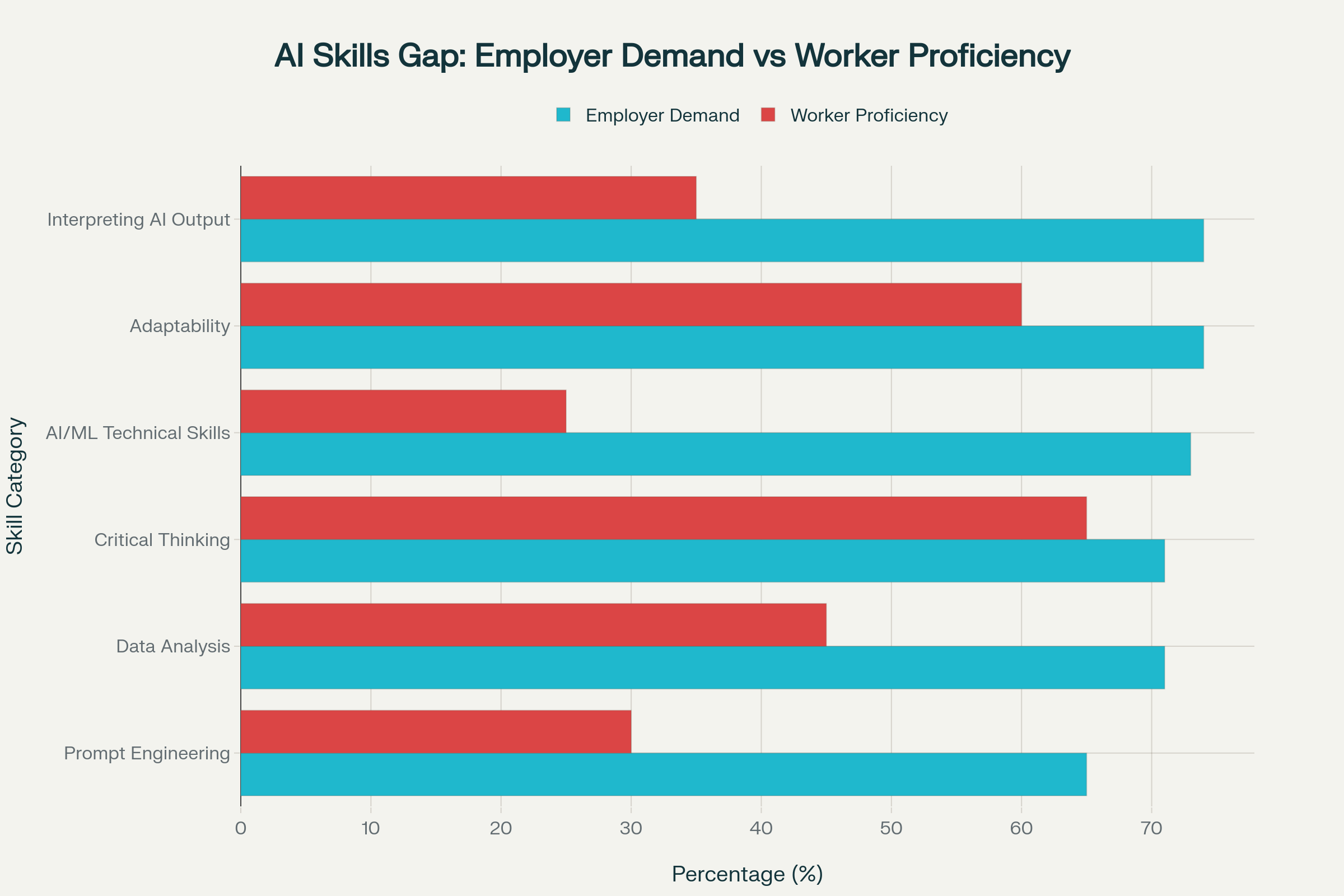

Critical Skills Gap

Significant skills gaps exist in AI/ML technical skills (73% demand vs 25% proficiency), interpreting AI output (74% vs 35%), and prompt engineering (65% vs 30%).

Major gaps exist between employer demand and worker proficiency. AI/ML technical skills show the largest gap (73% demand vs 25% proficiency), followed by interpreting AI output (74% vs 35%) and prompt engineering (65% vs 30%).2

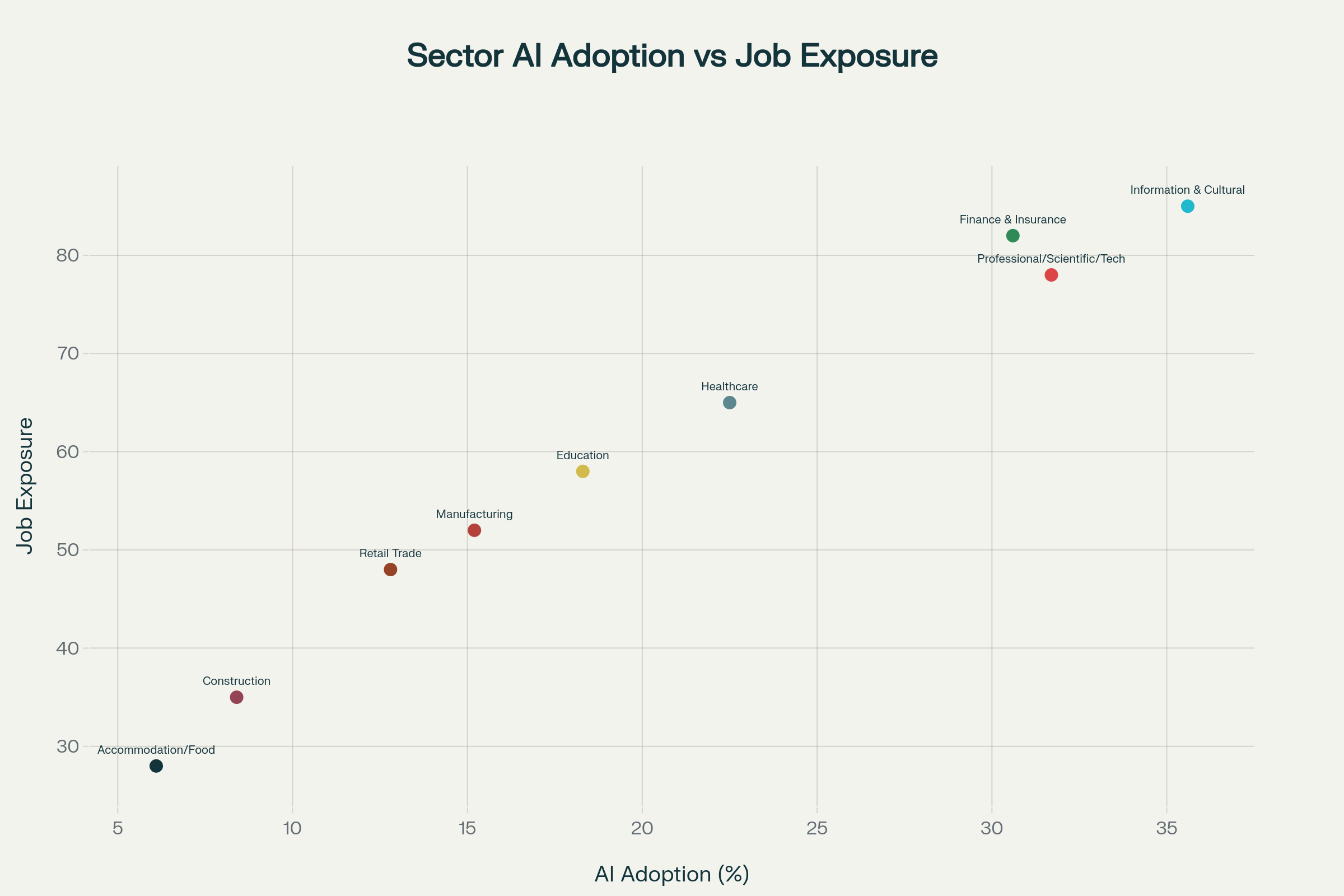

Sector Adoption vs Exposure

Sectors with higher job exposure to AI show stronger adoption rates, with information/cultural (35.6% adoption, 85 exposure), finance (30.6%, 82), and professional services (31.7%, 78) leading.

Clear correlation exists between job exposure and AI adoption rates. High-exposure sectors like information/cultural industries (85 exposure level, 35.6% adoption), finance (82 exposure, 30.6% adoption), and professional services (78 exposure, 31.7% adoption) lead adoption, while low-exposure sectors like construction (35 exposure, 8.4% adoption) and accommodation/food (28 exposure, 6.1% adoption) lag.3

These visualizations reveal that AI’s impact on Canada’s job market is creating clear winners and losers. Jobs requiring human creativity, judgment, and relationship skills are growing faster than ever, while routine task-based roles face significant pressure. The data strongly suggests that AI literacy and continuous upskilling are no longer optional—they’re essential for career resilience in 2025 and beyond.

Reference Links

-

https://lmic-cimt.ca/future-of-work/exposure-to-artificial-intelligence-in-canadian-jobs-experimental-estimates/ ↩

-

https://fsc-ccf.ca/wp-content/uploads/2025/09/canadas-workforce-in-transition_sept2025.pdf ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7

-

https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2025008-eng.htm ↩ ↩2

-

https://vectorinstitute.ai/ontario-ai-ecosystem-report-2024-25/ ↩

-

https://mscac.utoronto.ca/news/toronto-ranks-4th-in-north-american-tech-talent-driven-by-demand-for-ai-skills-cbre/ ↩

-

https://www.cbre.ca/insights/articles/with-ai-on-the-rise-toronto-takes-no-3-spot-in-cbres-tech-talent-ranking ↩

-

https://www.nucamp.co/blog/coding-bootcamp-canada-can-financial-services-the-complete-guide-to-using-ai-in-the-financial-services-industry-in-canada-in-2025 ↩

-

https://www.randstad.ca/job-seeker/career-resources/career-development/ai-powered-finance-career-growth/ ↩

-

https://www.fintech.ca/2025/10/09/royal-bank-canada-pulling-peers-ai-adoption-global-index/ ↩